Hurricane Helene, which recently devastated Florida and North Carolina, causing nearly a hundred deaths in the southeastern United States, is just the latest in a long series of extreme weather disasters.

Events like floods, hurricanes, and wildfires are becoming more frequent and destructive, even in Italy, as demonstrated by the recent flooding in Romagna. These disasters pose significant challenges for local communities, causing devastating losses to homes and belongings, while the insurance sector faces a growing volume of costly claims, ensuring fair and prompt distribution of funds.

Moreover, the manipulation of content and data, particularly altering metadata like geolocation and dates, complicates the process by fueling fraud and spreading disinformation. This creates challenges not only for insurance companies, which struggle to differentiate between genuine and tampered evidence used for claims, but also for honest citizens, who face delays in receiving compensation due to extended verification or disputes.

Manipulation of photos, videos, and metadata

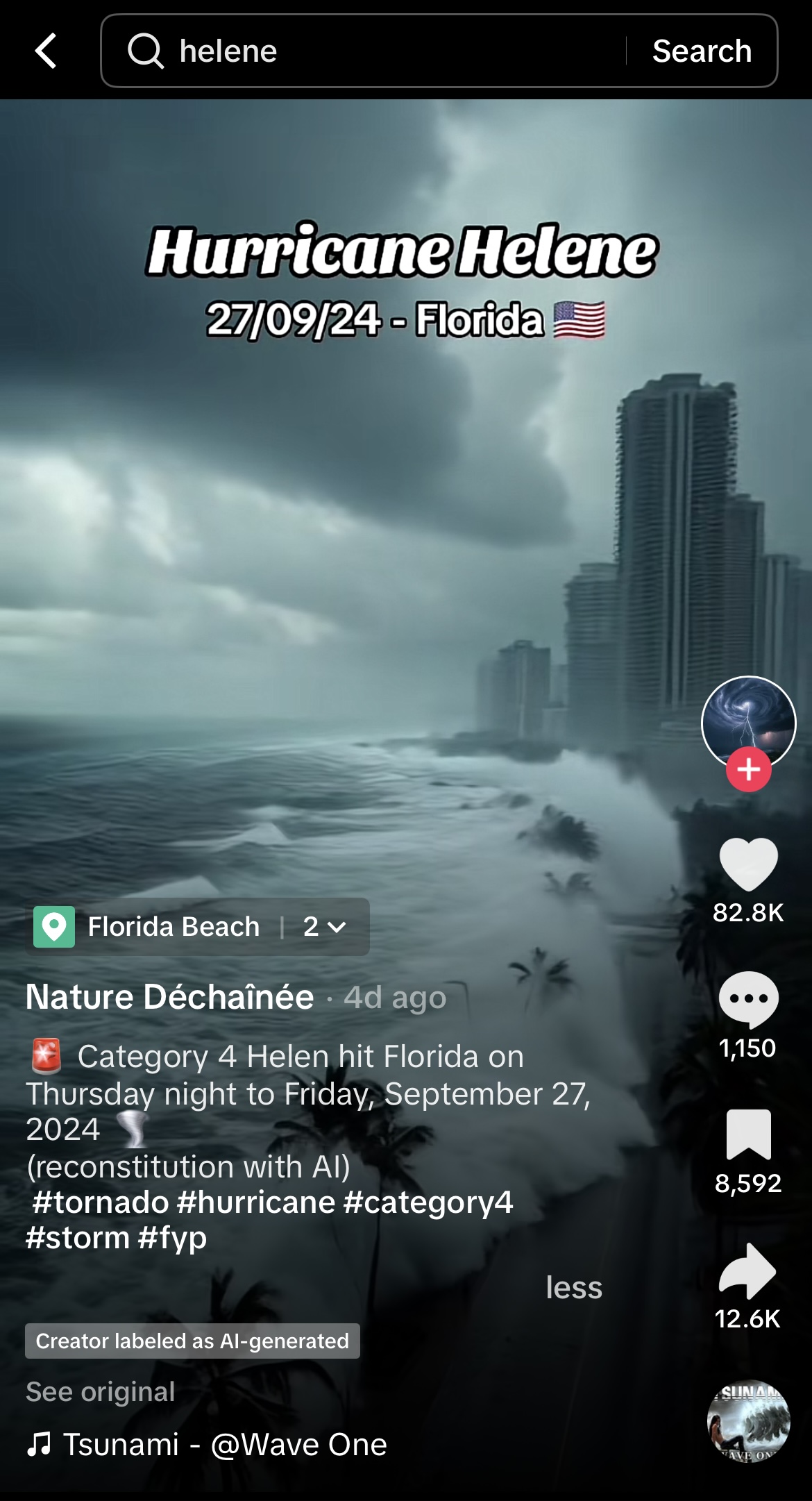

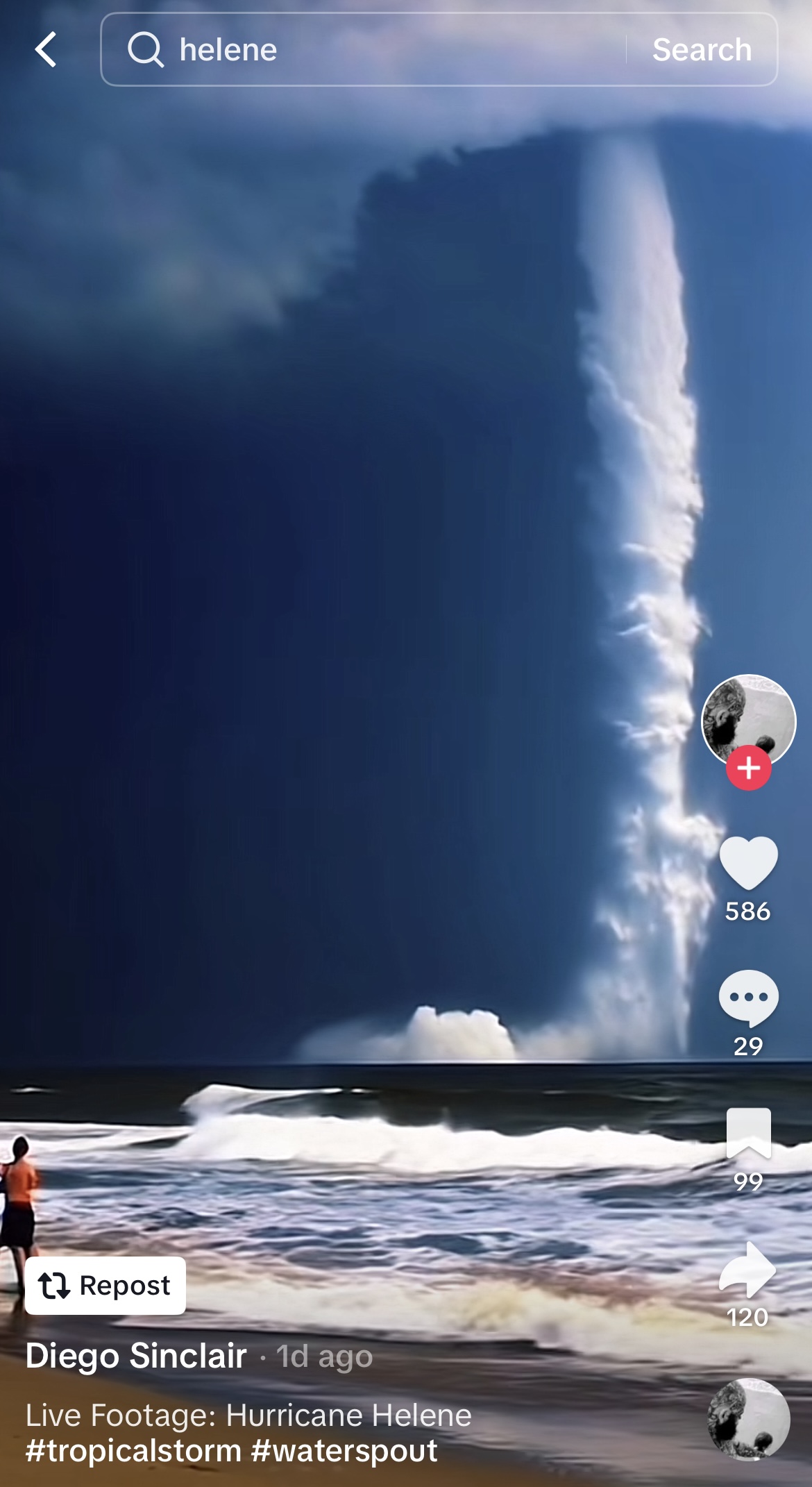

Today it is extremely easy to modify photos and videos or even generate them from scratch using artificial intelligence. This phenomenon has become widespread, and its dangers increase when such content is presented as evidence of facts or events.

Altering not only the visual aspects but also the metadata, such as geolocation or date, is just as easy and common, and this poses a particularly serious problem when photos and videos are to be used as reliable evidence, for instance, for insurance companies.

Even on social media platforms like TikTok, the content related to hurricane Helene highlights both sides of the coin: on one hand, people are documenting the real damage caused by the disaster; on the other, we see manipulation, with out-of-context or artificially generated content misrepresenting the storm.

Fraud and evidence verification: challenges for insurance companies

In a scenario where it is increasingly difficult to rely on digital information and evidence, insurance companies are forced to slow down the verification process to examine every detail to avoid becoming victims of fraudulent actions.

Even when manipulation isn’t obvious, the need for thorough checks delays payouts, impacting customers with legitimate claims. This is driving up costs in the insurance sector, particularly for home and water damage coverage.

The increase isn’t just due to climate change risks but also a rise in fraud, often linked to altered digital evidence. To address this, insurance companies must adopt advanced tools to verify the authenticity of submitted documentation.

TrueScreen: ensuring Fast and Secure Evidence Collection for Natural Disaster Claims

In this context, TrueScreen offers a patented solution to collect digital evidence with legal value, ensuring that all information is authentic and tamper-proof, preventing fraud, and reducing disputes and delays in compensation.

The first use of TrueScreen in the field occurred during the two floods that severely impacted Emilia Romagna for two consecutive years. In both cases, TrueScreen was made available for free and proved to be an “essential tool for legally documenting everything that the water damaged or destroyed,” providing indisputable evidence when filing compensation claims.

Based on this experience, a partnership was initiated with the Chamber of Commerce of Romagna, which integrated TrueScreen’s services for all businesses affected by these events, leading to significant improvements in the entire process of damage reporting and verification.

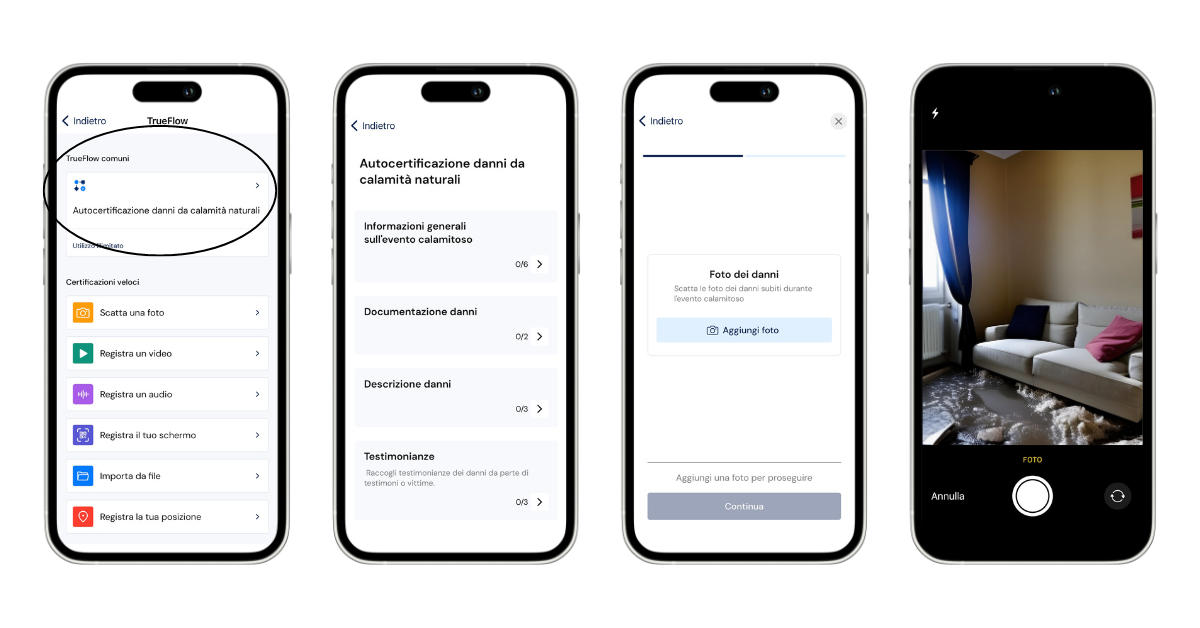

TrueScreen’s patented technology allows digital information to be certified in real time with legal value, ensuring authenticity and preventing manipulation. The app’s dedicated “Self-certification of natural disaster damages” flow makes documenting damage from natural disasters simple and intuitive. Users are guided step-by-step through the process of taking photos, with the option to add specific details about the event, such as disaster information, testimonies, and damage descriptions, ensuring accurate and immediate evidence collection.

In an era where trust in digital information is increasingly questioned, TrueScreen ensures transparency and reliability, protecting the interests of both insurers and policyholders and enabling fair and timely compensation.